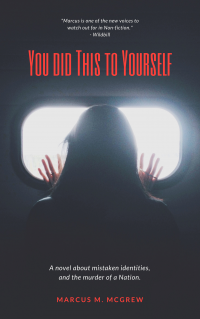

Biggest FRAUD ever

America The "Rip off" First it was "Pension fund socialism" in the 1970s, in which the people owned and shaped the corporations. Next it was "improving shareholder value" in the 1980s by forcing boards of directors to take their fiduciary values more seriously and thereby help ordinary stockholders and institutional investors, such as public pension funds. By the 1990s, it was "investor capitalism" driven by pension fund activists who were going to get rid of underperforming top executives. The beat went on in the 2010s -- de...

Read books

FAQ

Contact me

Terms of Use

Privacy Policy

|

|

Home

| About us

|

Get published!

|

Sign in

|

|